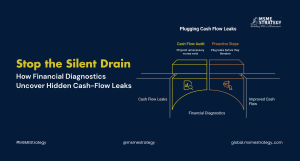

Stop the Silent Drain: How Financial Diagnostics Uncover Hidden Cash-Flow Leaks in SMEs

Hidden cash-flow leaks quietly erode profitability in many SMEs. Through structured financial diagnostics, business leaders can uncover inefficiencies, strengthen liquidity, and make data-driven decisions for sustainable growth. This article outlines a practical, step-by-step framework to audit cash flows, detect hidden losses, and build a more resilient, profitable enterprise.