Why SMEs Need Fractional CFO Services

For many small and mid-sized enterprises (SMEs), hiring a full-time Chief Financial Officer (CFO) is often too costly or unnecessary for day-to-day operations. Yet, financial strategy, compliance, and cash flow management are critical to success. Fractional CFOs bridge this gap by offering high-level financial expertise on a flexible, part-time basis—providing SMEs with strategic financial management without the full-time expense.

In this blog, we explore 10 essential Fractional CFO services that can help streamline your business, enhance financial health, and improve decision-making.

10 Key Fractional CFO Services for SMEs

1. Financial Strategy & Planning

A Fractional CFO develops a financial roadmap aligned with your business goals. They analyze financial data, forecast growth opportunities, and ensure sustainable financial planning.

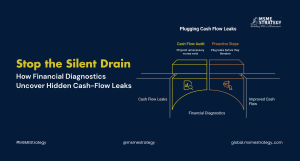

2. Cash Flow Management & Forecasting

Managing cash flow is vital for SMEs. A Fractional CFO tracks inflows and outflows, predicts shortages, and optimizes payment cycles to maintain healthy working capital.

3. Budgeting & Cost Control

Keeping expenses in check is crucial. Your CFO will develop cost-control measures, analyze spending patterns, and implement budgeting best practices to maximize profitability.

4. Financial Reporting & Compliance

Staying compliant with financial regulations is a challenge for SMEs. Fractional CFOs prepare financial statements, ensure tax compliance, and adhere to accounting standards to avoid legal risks.

5. Investment & Capital Advisory

Need funding? A Fractional CFO advises on capital-raising strategies, connects businesses with investors, and optimizes funding sources to support growth.

6. Profitability Analysis & Pricing Strategies

Are your products or services priced correctly? Fractional CFOs analyze profit margins, optimize pricing models, and identify revenue-generating opportunities to boost profitability.

7. Risk Management & Business Resilience

From economic downturns to supply chain issues, a Fractional CFO helps SMEs assess financial risks, create contingency plans, and build business resilience for long-term stability.

8. Tax Planning & Optimization

Effective tax strategies can save SMEs thousands of dollars. A CFO implements tax-saving measures, ensures compliance, and maximizes deductions to reduce tax liabilities.

9. Technology & Financial Automation

With AI-driven finance tools and cloud accounting solutions, a Fractional CFO introduces automation, optimizes ERP software, and integrates financial tech to streamline operations.

10. Mergers, Acquisitions & Exit Strategies

Whether planning a merger, acquisition, or business exit, a CFO conducts valuation, negotiates deals, and ensures smooth transitions for business scalability or succession planning.

Latest Trends in SME Financial Management

The global SME sector is evolving with new financial management trends. Here are some key advancements:

AI-Powered Financial Insights – SMEs are leveraging AI-driven analytics for real-time financial decision-making.

Cloud-Based Accounting – Tools like QuickBooks and Xero are transforming how businesses manage finances remotely.

Automated Cash Flow Forecasting – Predictive finance tools help SMEs anticipate cash shortages and optimize spending.

Outsourced Finance Teams – More SMEs are turning to Fractional CFOs and virtual finance teams instead of in-house finance departments.

By embracing these trends, SMEs can enhance financial efficiency, reduce risks, and drive sustainable growth.

Actionable Steps to Leverage Fractional CFO Services

1. Assess Your Financial Needs – Identify which CFO services can benefit your business the most.

2. Choose the Right CFO Model – Decide between part-time, project-based, or retainer CFO services.

3. Implement Financial Automation – Use technology to streamline processes and improve efficiency.

4. Monitor Performance Metrics – Regularly review financial reports, cash flow, and profit margins.

5. Work with Experts – Partner with experienced consultants to maximize financial strategies.

Looking for expert guidance? MSME Strategy Consultants (global.msmestrategy.com) offer tailored Fractional CFO solutions to help SMEs achieve financial success.

By adopting Fractional CFO services, SMEs can enhance financial efficiency, improve cash flow, and drive long-term profitability—all while keeping costs manageable.

#GlobalMSMEStrategy #FractionalCFO #SMEFinance #BusinessGrowth #FinancialStrategy