From AI-driven forecasting to fintech-led funding, the rules of cash flow management are changing rapidly — and SMEs that fail to adapt are at risk of being left behind.

In a world where geopolitical shocks, inflation spikes, and supply chain unpredictability are the new norm, cash flow has become more than a financial metric — it’s a strategic lifeline. Yet, many small and medium enterprises (SMEs) are still relying on outdated methods of financial planning that don’t stand up to today’s volatility.

The latest global trends tell a different story:

- AI-powered tools now offer real-time visibility and predictive insights into cash positions.

- Fintech lending platforms are unlocking faster, more flexible funding for SMEs with limited credit history.

- Embedded finance is blurring the lines between operational platforms and financial services, making liquidity management more seamless than ever.

- Scenario-based planning and stress-testing models are being widely adopted, helping CFOs steer through multiple market realities.

This isn’t just evolution — it’s a strategic reset in how forward-thinking SME leaders approach financial resilience.

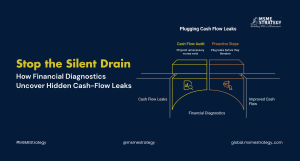

So, how can CFOs and business owners bridge the cash flow gap before it widens? Let’s break down the actionable strategies and the tools that are making a global impact.

Key CFO Strategies to Bridge the Cash Flow Gap

To build financial resilience, CFOs in SMEs are increasingly adopting the following strategies:

1. Real-Time Cash Flow Forecasting

Modern CFOs are leveraging AI-powered forecasting tools that provide real-time insights into cash positions. These tools integrate with accounting software, helping predict shortfalls before they happen and enabling swift corrective action.

2. Diversification of Revenue Streams

SMEs globally are rethinking their revenue models — from launching digital products to entering new markets. Diversification not only boosts cash inflow but also cushions against seasonal slumps or industry downturns.

3. Optimizing Working Capital

Strategic inventory management, negotiating better credit terms with suppliers, and speeding up receivables are crucial. Using automated invoicing systems and e-payments helps streamline collections and reduce days sales outstanding (DSO).

4. Accessing Alternative Financing

With traditional lending being rigid or slow, SMEs are exploring fintech-based lending platforms, invoice factoring, and crowdfunding. These solutions are faster, tech-enabled, and often more accessible for smaller firms with limited collateral.

5. Scenario Planning & Stress Testing

Volatile markets demand more than just reactive planning. Leading CFOs conduct scenario analysis to anticipate multiple financial outcomes, preparing contingency plans for worst-case scenarios.

Emerging Global Trends in SME Financial Strategy

Staying ahead means staying informed. Here are some of the latest trends shaping financial planning in the SME sector:

- Embedded Finance: Financial services are being integrated into non-financial platforms (like e-commerce or SaaS platforms), giving SMEs easier access to credit, payments, and insurance without leaving their business apps.

- Digital-First Banking: Neo-banks and digital-only lenders are increasingly SME-friendly, offering tailored products with faster approvals and fewer bureaucratic hurdles.

- Sustainability-Linked Finance: Green loans and ESG-aligned credit are gaining traction. SMEs embracing sustainability may benefit from better financing rates and investor interest.

- Blockchain in Trade Finance: For export-oriented SMEs, blockchain is simplifying cross-border transactions, ensuring quicker payments and lower risk.

Actionable Takeaways for SME Owners and CFOs

🔹 Implement a real-time cash flow dashboard to monitor daily inflows and outflows.

🔹 Review and renegotiate supplier and client payment terms to create buffer days.

🔹 Explore non-traditional financing options like P2P lending or invoice discounting platforms.

🔹 Create a 3-scenario cash flow forecast: best case, most likely, and worst case.

🔹 Digitize financial operations wherever possible — from accounting to collections.

🔹 Build a cash reserve policy and review it quarterly.

🔹 Invest in training your finance team in emerging fintech and forecasting tools.

In times of uncertainty, proactive financial planning isn’t just a survival tactic — it’s a competitive edge. By leveraging innovative tools, embracing new financing models, and cultivating strategic foresight, SME CFOs can not only bridge cash flow gaps but also build long-term financial resilience.

Experienced consultants at MSME Strategy Consultants are ready to support your business through strategic financial planning tailored to global SME challenges.

#MSMEStrategy #pankajchawlaofficial #CFOInsights #CashFlowManagement #SMEs #BusinessResilience #FinancialPlanning #GlobalSMEs #FintechForSMEs