In today’s competitive business environment, small and medium enterprises (SMEs) cannot afford to treat financial transaction management as an afterthought. The accuracy and timeliness of daily transaction recording and classification form the backbone of strategic decision-making, tax compliance, and cash flow forecasting. With global supply chains becoming more integrated and regulations more stringent, aligning with international best practices in financial recordkeeping is not just a matter of operational hygiene—it is a matter of long-term business viability.

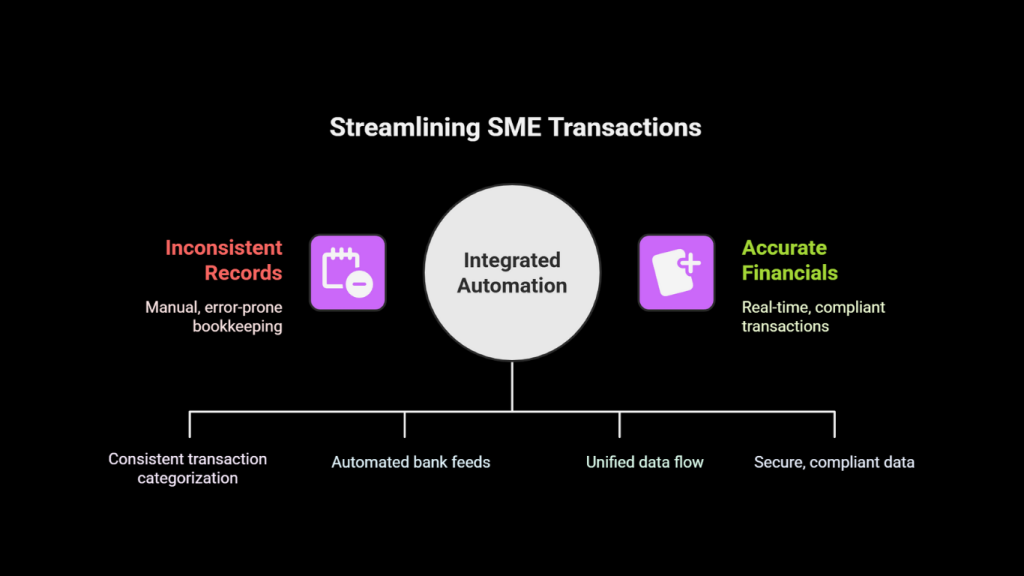

Across markets, leading SMEs are transitioning from fragmented, spreadsheet-based systems to intelligent accounting platforms that provide real-time insights and seamless integration with other business functions. These systems are not only increasing accuracy and efficiency but also reshaping how SMEs manage their financial health and investor reporting.

Global Best Practices in Transaction Recording and Classification

SMEs across geographies are now adopting a principle-centered approach anchored on automation, cloud-based access, and real-time classification frameworks. The foundation of these best practices lies in a few key areas:

First, consistency in the chart of accounts, aligned with IFRS or other regional financial standards, ensures that transaction categorization remains meaningful over time. Second, real-time reconciliation through bank feeds or payment gateways has become the norm rather than the exception. Third, the integration of accounting with inventory, payroll, and CRM systems is ensuring that no transaction remains unrecorded or duplicated. Lastly, audit trails and role-based access controls are becoming standard, offering SMEs an added layer of data security and compliance readiness.

Global Tools Leading the Way

Several digital tools have emerged as front-runners in this transformation. Xero, headquartered in New Zealand, is globally recognized for its intuitive interface and powerful automation. It allows SMEs to automatically import bank statements, categorize transactions using AI-driven rules, and collaborate in real-time with their accountants. Its multi-currency support and mobile accessibility make it especially suitable for SMEs operating across borders.

QuickBooks Online, with a strong foothold in North America and growing adoption globally, provides seamless bank integration, expense tracking, and project-level cost classification. Its dashboard-driven UI helps decision-makers spot red flags early—whether it’s unexpected spending, delayed receivables, or underperforming revenue channels.

Zoho Books, gaining ground in Asia, Africa, and the Middle East, is deeply appreciated by SMEs for its affordability, automation of recurring transactions, and integration across Zoho’s ecosystem—particularly beneficial for service-based SMEs that need CRM-accounting alignment.

Meanwhile, Wave remains a preferred option for early-stage startups and micro businesses due to its freemium model and straightforward interface. Though limited in scale, it covers the essentials of invoicing, receipt scanning, and categorization for those starting their formal accounting journey.

Real-World SME Use Cases

Across continents, SMEs are leveraging these tools to solve long-standing operational pain points. A textile exporter in Vietnam using Xero integrated with Hubdoc was able to reduce manual data entry by 80%, freeing up valuable time for strategic planning. A tech services SME in South Africa using Zoho Books improved their tax compliance through automated VAT tracking and report generation, significantly reducing the risk of audit penalties. In Canada, a digital marketing agency using QuickBooks Online automated all recurring client billing and used real-time dashboards to align cash flow with payroll cycles, leading to higher employee retention and better budget forecasting.

These platforms are not just systems of record—they are systems of intelligence. They enable faster closure of books, better investor reporting, and real-time analytics that inform tactical decisions, from pricing to procurement. In many ways, they level the playing field, allowing SMEs to adopt enterprise-grade financial practices at a fraction of the cost.

Actionable Steps for SME Leaders

To adopt these global best practices effectively, seasoned leaders should begin by evaluating their current accounting workflows and identifying redundancies or risks. Invest in training your finance teams—not just in how to use tools, but in understanding the principles behind transaction classification and compliance. Choose a tool that aligns with your operational complexity, regional regulatory environment, and scalability requirements.

Critically, ensure that these systems are not implemented in silos. Integrate them with inventory, HR, and CRM platforms to build a single source of truth across the enterprise. Regular audits, both internal and external, must accompany this digital shift to ensure continued accuracy and resilience.

At MSME Strategy Consultants (global.msmestrategy.com), our experienced consultants are ready to help your enterprise design and implement transaction management frameworks that meet global standards while respecting local realities.

#GlobalMSMEStrategy #SMEFinance #DigitalAccounting #TransactionAutomation #CFOLeadership #AccountingInnovation #FinancialIntelligence #MSMEStrategy