Bank reconciliation has always been one of the most essential yet time-consuming tasks in financial management. For SMEs, where efficiency and accuracy directly impact decision-making and cash flow, the shift from manual reconciliation to automation-driven processes is not just a convenience — it’s a necessity.

In today’s digital era, automated reconciliation tools are transforming the way businesses maintain financial accuracy, catch discrepancies in real time, and free up hours of valuable time for finance teams across the globe.

The Problem with Manual Reconciliation

Traditional reconciliation methods require finance teams to painstakingly match transactions between bank statements and accounting records. This manual process is:

- Error-prone – Small mistakes in data entry can cascade into larger financial reporting issues.

- Time-intensive – Hours or even days can be lost each month in reconciliation cycles.

- Reactive, not proactive – Discrepancies are often discovered long after they’ve caused problems.

For SMEs competing in fast-paced global markets, these limitations can hold back growth.

How Automation Transforms the Process

Automated bank reconciliation tools harness artificial intelligence (AI), machine learning (ML), and cloud-based integrations to revolutionize this critical function. They:

- Automatically match transactions between bank feeds and accounting software.

- Flag discrepancies instantly, giving finance teams real-time visibility into potential issues.

- Integrate seamlessly with global banks and ERP systems, supporting businesses with international operations.

- Provide audit-ready accuracy, strengthening compliance and reporting standards.

What once required hours of manual effort now takes minutes — with far greater precision.

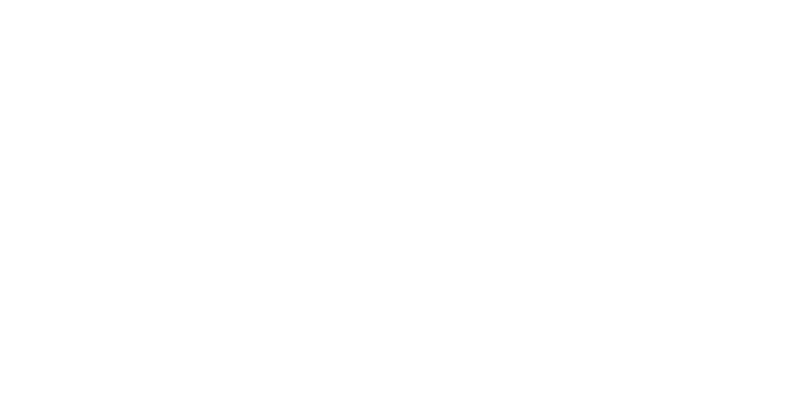

Key Benefits for SMEs

- Error Reduction: Automated matching significantly lowers the risk of human mistakes.

- Time Savings: Finance teams reclaim hours each month, allowing focus on strategic tasks.

- Faster Decision-Making: Real-time visibility into cash flow empowers business leaders.

- Stronger Compliance: Automation creates transparent, auditable records.

- Scalability: Global SMEs can manage multiple currencies, accounts, and subsidiaries with ease.

Global Trends in Automated Finance Tools

Across regions, SMEs are rapidly adopting reconciliation automation as part of a larger digital finance transformation strategy:

- In Europe, regulatory frameworks like PSD2 are driving secure bank-data integration.

- In North America, SMEs are leveraging cloud ERP platforms with built-in reconciliation automation.

- In Asia-Pacific, fintech adoption is rising sharply, giving SMEs advanced tools at lower costs.

This global shift signals that automation is no longer optional — it’s a competitive advantage.

Actionable Steps for SMEs

If your business still relies on manual reconciliation, here are immediate steps you can take:

- Assess Current Processes: Identify where manual errors and delays occur.

- Explore Cloud-Based Tools: Look for software that integrates directly with your banks and accounting systems.

- Start Small, Scale Fast: Pilot automation in one business unit, then expand globally.

- Train Your Finance Team: Ensure they understand both the technology and the new workflow.

- Partner with Experts: Engage consultants who specialize in SME digital transformation.

At MSME Strategy Consultants (global.msmestrategy.com), experienced consultants are ready to help your business transition to smart, automated financial practices that drive global growth.

#GlobalMSMEStrategy #SMEFinance #Automation #DigitalTransformation #SmartReconciliation #ErrorFreeBooks