As an experienced SME owner, you already know that financial management is not just about keeping records—it’s about making smart decisions that drive your business forward. The challenge lies in finding solutions that not only keep your books in order but also save time, reduce costs, and ensure compliance with ever-changing regulations. With so many options available, from AI-driven automation to outsourced bookkeeping, making the right choice can feel overwhelming.

This article explores the latest accounting and bookkeeping solutions, emerging industry trends, and expert recommendations to help you streamline your financial processes.

The Everyday Accounting Struggles of SME Owners

If you’ve ever found yourself spending more time managing books than focusing on business growth, you’re not alone. Many SME owners grapple with:

Time-consuming manual bookkeeping – Financial record-keeping often feels like an endless task.

Complex tax and compliance requirements – Laws change frequently, making it tough to stay compliant.

High costs of in-house accountants – Not every SME can afford a full-time financial expert.

Lack of financial visibility – Without real-time insights, making sound decisions becomes difficult.

Cash flow worries – Staying on top of income and expenses can be a constant struggle.

🔍 Does any of this sound familiar? Let’s explore the latest solutions that can ease your burden.

Emerging Trends in SME Accounting & Bookkeeping

Technology is reshaping how businesses handle their finances. Here’s what’s trending and why it matters:

AI-Powered Bookkeeping That Works for You

Imagine software that categorizes transactions, flags inconsistencies, and automates invoicing—without you lifting a finger. AI-driven platforms like Xero and QuickBooks are making bookkeeping effortless and error-free.

Cloud Accounting for Anywhere, Anytime Access

Gone are the days of being tied to a desktop. Cloud-based tools like Sage and Zoho Books allow you to manage your accounts in real time, from anywhere in the world.

✍️ Pro Tip: If your accounting software isn’t cloud-based yet, you might be missing out on major efficiency gains!

Outsourcing Your Bookkeeping Without Losing Control

More SMEs are turning to virtual CFOs and outsourced bookkeeping services to handle financial tasks efficiently while cutting costs. It’s a game-changer for those looking to scale smartly.

Blockchain for Secure, Transparent Transactions

For businesses dealing with international transactions, blockchain technology enhances security, reduces fraud risks, and speeds up payments.

Integrated Financial Management Systems

All-in-one solutions that combine accounting, payroll, and expense tracking give you a complete financial picture, helping you make better business decisions.

📌 With the right technology, financial management stops being a burden and becomes a strategic advantage!

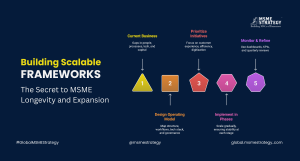

How MSME Strategy Consultants Can Help

Choosing the right accounting solution is just one part of the puzzle. MSME Strategy Consultants (global.msmestrategy.com) provide expert guidance to help you:

✔️ Select the best financial tools tailored to your business needs.

✔️ Optimize cash flow management to prevent financial bottlenecks.

✔️ Stay compliant with evolving tax regulations effortlessly.

✔️ Reduce bookkeeping costs by implementing smarter, automated solutions.

✔️ Leverage financial insights to make data-driven decisions for long-term growth.

💡 The right financial strategy can mean the difference between merely surviving and truly thriving.

Your Next Steps

-Evaluate your current accounting setup – Identify what’s working and what’s not.

-Embrace technology – If you’re still using outdated methods, it’s time to upgrade.

-Consider outsourcing – If bookkeeping is eating into your productivity, explore virtual CFO services.

-Stay ahead of compliance requirements – Get expert help to avoid legal pitfalls.

-Track your financial data closely – Make informed decisions using real-time insights.

-Consult with professionals – Get personalized strategies from MSME Strategy Consultants to make your accounting seamless and stress-free.

Final Thought: Managing your SME’s finances shouldn’t be a burden. With the right solutions and expert advice, you can streamline your bookkeeping, stay compliant, and focus on what truly matters—growing your business.

For tailored financial strategies, reach out to MSME Strategy Consultants (global.msmestrategy.com)—our experienced consultants are ready to help you navigate the evolving world of SME finance.

#GlobalMSMEStrategy #SMEFinance #AccountingSolutions #CloudAccounting #AIinFinance #BookkeepingForSMEs #FinancialGrowth #MSMEStrategy