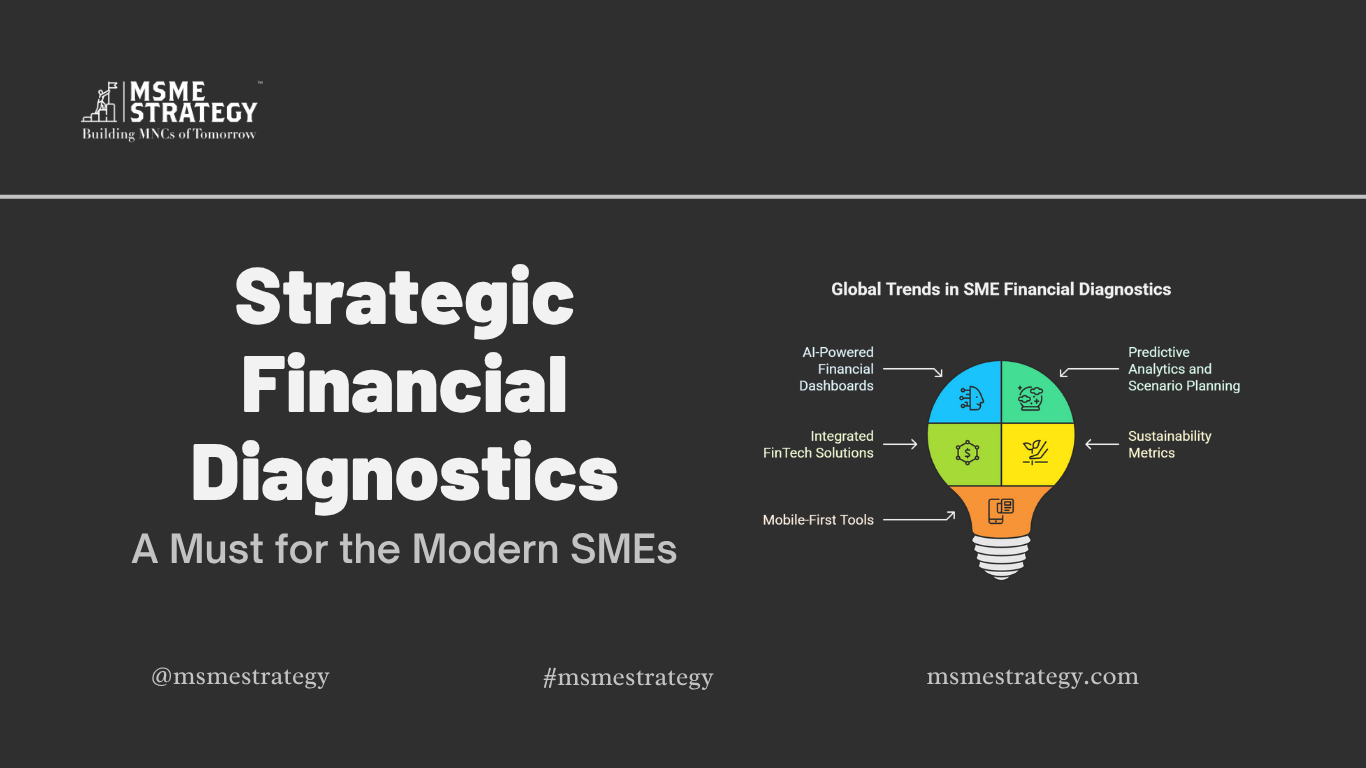

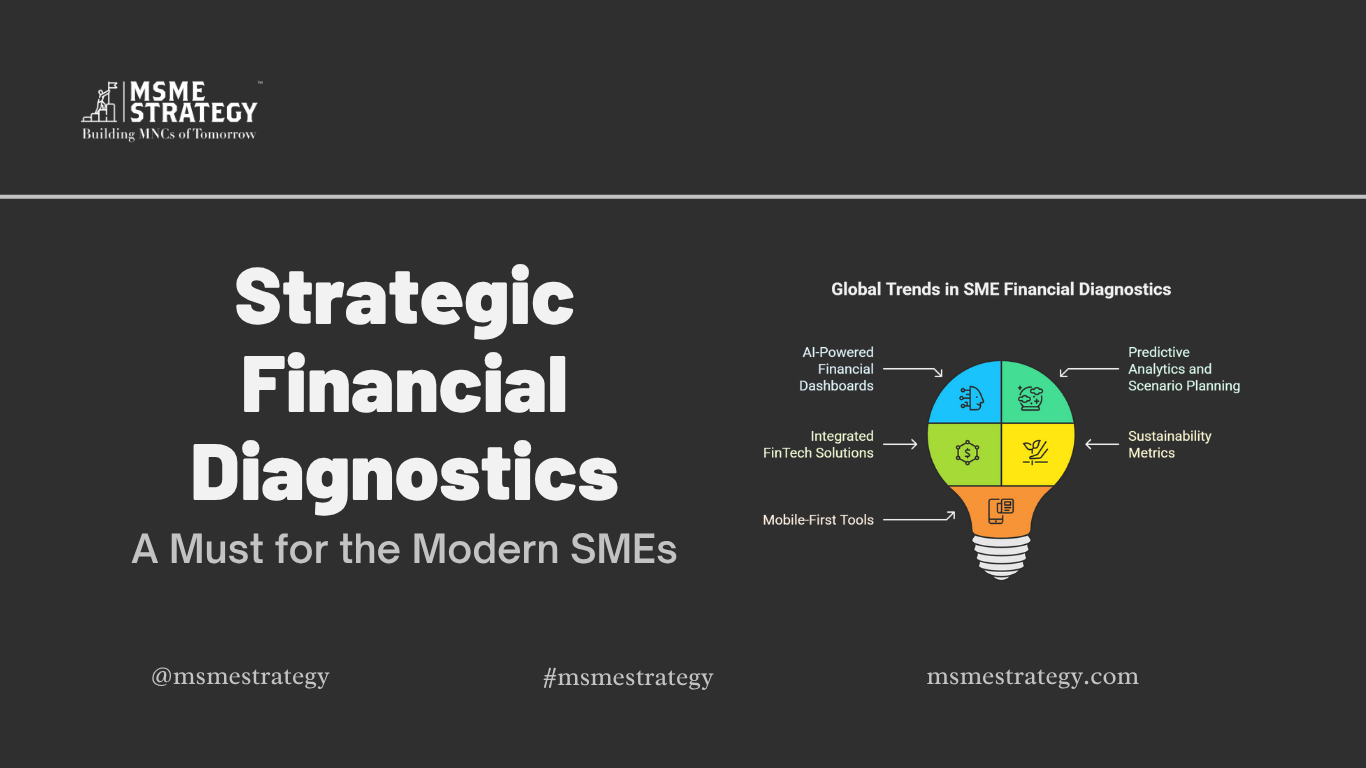

Strategic Financial Diagnostics: A Must for the Modern SME

The ability to interpret real-time financial data has evolved from a competitive edge to an operational necessity. In today’s interconnected markets, even marginal inefficiencies in

The ability to interpret real-time financial data has evolved from a competitive edge to an operational necessity. In today’s interconnected markets, even marginal inefficiencies in

Wondering when your cash will run out? Financial modeling and budgeting aren’t just for CFOs anymore. From intuitive dashboards to AI-powered forecasts, SMEs worldwide are using smart tools to plan better, grow faster, and present with confidence. Learn how to make numbers work for you—even if you’re not a finance pro.

The biggest challenge for SMEs isn’t just survival—it’s scaling sustainably. Whether you’re an early-stage startup or an established SME aiming to break through growth ceilings,

While industry benchmarks offer a helpful external reference, true profitability lies in knowing where your SME deviates—and why. Margin diagnostics empowers CFOs to analyze customer, product, and operational data, exposing inefficiencies that traditional reporting misses. The result: faster decisions, sharper margins, and stronger resilience.

For SMEs worldwide, financial clarity starts with the CFO’s monthly checklist. Monitoring KPIs such as revenue growth, working capital, and ROI allows for informed decision-making. The adoption of AI, cloud tools, and global benchmarking trends can help businesses remain competitive in the current market environment.

SMEs worldwide face a new kind of financial pressure: unpredictable markets and widening cash flow gaps. From AI forecasting to fintech lending, CFOs are rewriting the playbook. Discover how modern strategies and tools can help future-proof your business.

In 2025, real-time financial diagnostics are transforming how SMEs manage their cash flow. From AI-powered dashboards to embedded finance tools, businesses now have instant access to insights that drive smarter, faster decisions. This global shift empowers SMEs to stay agile, forecast better, and thrive—because in today’s economy, cash flow isn’t just king—it’s everything.

In an AI-driven world, SMEs are transforming their finance operations by automating repetitive, time-consuming tasks. From invoicing to cash flow forecasting, smart finance automation boosts accuracy and scalability. This article explores 7 practical ways small businesses in the UK, Europe, and the USA can streamline their financial processes and operate with greater efficiency.