Business diagnostics—a structured process of assessing the health and performance of an organization—has emerged as a strategic imperative for SMEs looking to pivot, scale, or sustain growth. For seasoned SME professionals, understanding how to conduct effective diagnostics and leverage the right tools is key to making informed decisions that drive value and resilience.

Why Business Diagnostics Matter

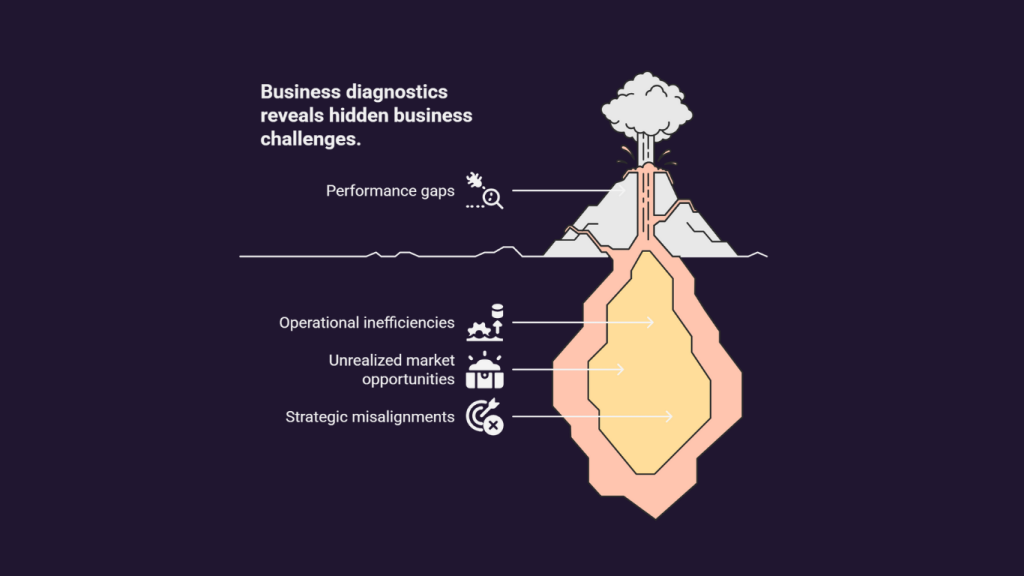

At its core, business diagnostics goes beyond traditional financial audits. It provides a comprehensive 360-degree assessment of your organization—covering strategy, operations, people, markets, finances, and technology. The goal is to identify:

- Performance gaps

- Operational inefficiencies

- Unrealized market opportunities

- Strategic misalignments

In a world where market volatility, digital disruption, and sustainability pressures are constant, business diagnostics enables SMEs to future-proof their strategies with actionable insights.

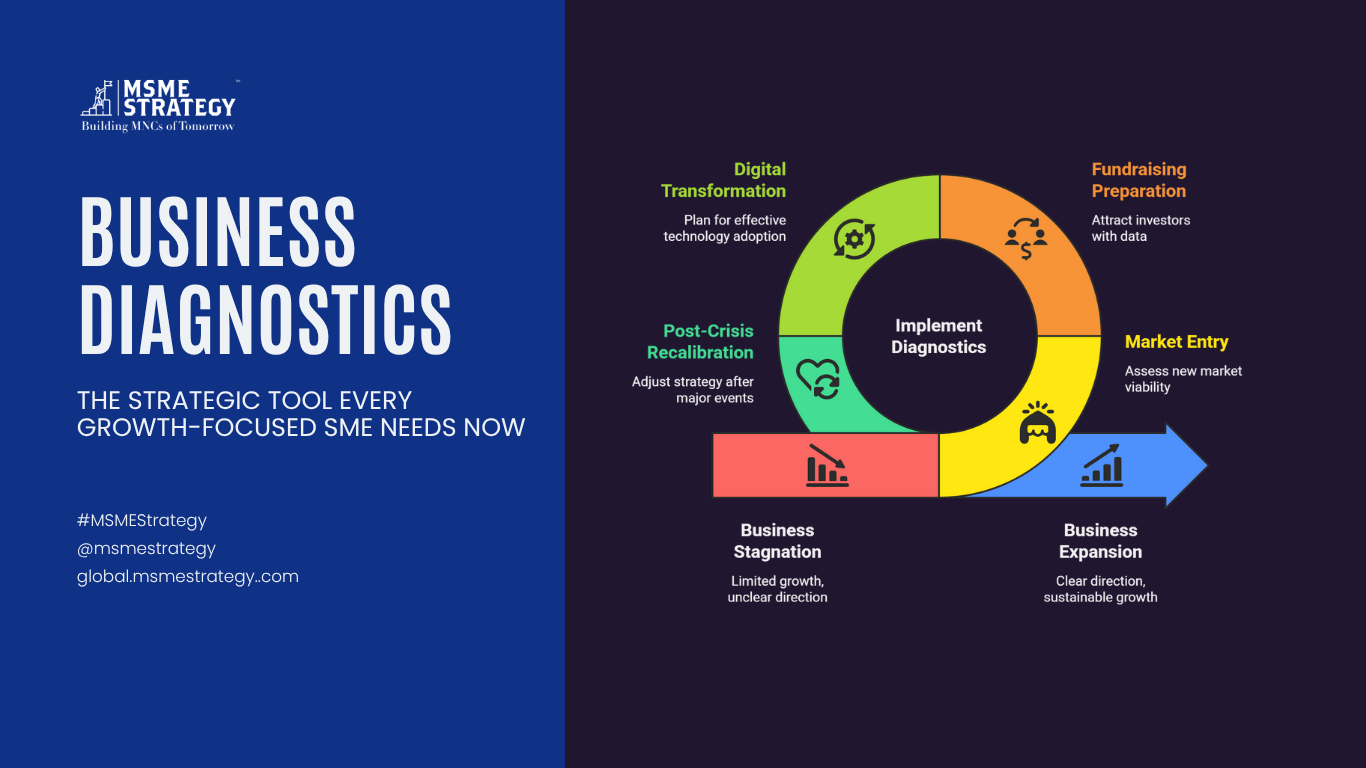

When Should SMEs Consider Diagnostics?

Seasoned business leaders understand that timing is crucial. You should initiate a diagnostic process when:

- Entering new markets or launching new products

- Preparing for fundraising or strategic partnerships

- Experiencing stagnation despite operational activity

- Planning digital transformation or sustainability shifts

- Recalibrating strategy post-crisis or post-COVID impact

Diagnostics is not just a tool for correction—it’s also a compass for expansion.

How to Conduct Business Diagnostics

- Set a Clear Objective

Begin with a diagnostic goal: Is it operational efficiency? Strategic clarity? Financial restructuring? - Use a Structured Framework

Adopt a multi-dimensional approach that evaluates internal capabilities, external market alignment, financial health, and digital maturity. - Engage Key Stakeholders

Ensure leadership, departmental heads, and even frontline staff are involved. This enhances data quality and team ownership. - Leverage Data and Benchmarking

Use qualitative and quantitative data—along with global benchmarks—to contextualize your performance. - Interpret, Prioritize, and Act

Don’t stop at insights. Turn diagnostic findings into a roadmap of high-impact strategic actions.

Popular Diagnostic Tools for SMEs (Global View)

- MSME Strategy Diagnostics Toolkit

A modular and customizable suite from MSME Strategy Consultants (global.msmestrategy.com) that covers financial health, strategic fit, capability maturity, market positioning, and ESG alignment. - Business Model Canvas

Ideal for visualizing and stress-testing your current business model. - McKinsey’s 7S Framework

Assesses organizational alignment in structure, systems, style, staff, skills, strategy, and shared values. - SWOT + PESTLE Hybrid Analysis

Used to link internal capabilities with external environmental dynamics. - Balanced Scorecard

Aligns business activities to the vision and strategy by measuring performance across four perspectives: financial, customer, internal process, and learning & growth. - OECD SME Performance Review Indicators

For benchmarking against global standards in productivity, innovation, and trade readiness.

Actionable Steps for SMEs

-Schedule an Annual Diagnostic Review – Embed diagnostics as a strategic routine, not a one-off event.

-Map Insights to KPIs – Tie diagnostic findings to measurable performance indicators.

-Invest in Diagnostic Literacy – Train senior managers in understanding and interpreting diagnostic results.

-Co-create Solutions with Experts – Work with external consultants who bring objectivity, frameworks, and cross-industry insight.

–Use Digital Dashboards – Visualize diagnostics data using BI tools like Power BI or Tableau to track progress in real time.

In a global SME landscape where agility and insight define competitiveness, business diagnostics is not optional—it’s foundational. Whether you’re in Nairobi, New Delhi, or New York, the strategic use of diagnostics will position your SME to outpace change, mitigate risk, and capture value.

MSME Strategy Consultants (global.msmestrategy.com) brings deep expertise and global experience to support your business diagnostics journey. Our experienced consultants are ready to help you turn insight into growth.

#GlobalMSMEStrategy #SMEGrowth #BusinessDiagnostics #SMETools #SMETransformation #StrategicSMEs #MSMEConsulting #DigitalSME #ResilientSMEs