“When does my cash run out?”

It’s a simple question—but for many small and medium-sized enterprises (SMEs), it’s not easy to answer without solid financial modeling and budgeting practices in place. As global markets shift rapidly, having clear visibility into your finances isn’t just helpful—it’s essential.

From founders to operations heads—even engineers—financial tools today are being built to empower non-finance professionals with intuitive, actionable insights. Whether you’re managing a SaaS platform or running a traditional business, modern financial models can help you project, plan, and present with confidence.

Why Financial Modeling and Budgeting Matter for SMEs

SMEs often operate with tighter margins and more volatile cash flow than larger firms. Financial modeling helps you:

- Predict when you’ll need more cash—and when you can invest it.

- Plan for best- and worst-case scenarios.

- Build credibility with investors and lenders.

- Align teams around realistic growth targets and operational goals.

A good budgeting system doesn’t just track expenses; it tells the story of your business’s future—what it can afford, where it’s heading, and how it can course-correct.

Financial Models Anyone Can Use—Even Engineers!

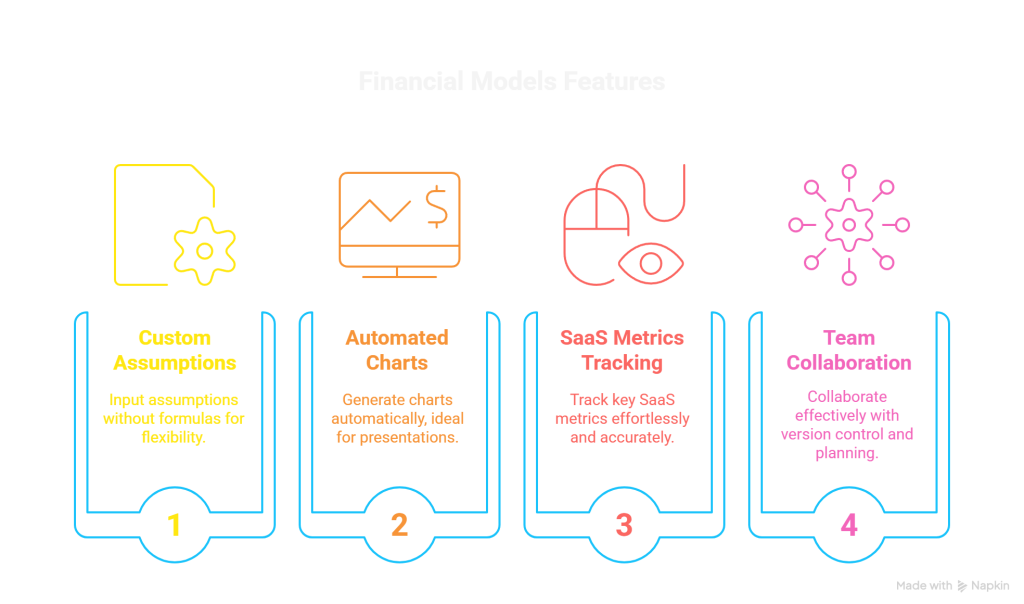

Today’s financial modeling tools are no longer restricted to CFOs or Excel experts. User-friendly platforms now allow you to:

- Input custom assumptions (e.g., customer growth, pricing tiers, hiring plans) without writing formulas.

- Automatically generate charts for forecasts vs. actuals—perfect for investor decks or board meetings.

- Track SaaS metrics like MRR, churn, CAC, and LTV effortlessly.

- Collaborate across teams with version control, scenario planning, and real-time updates.

These tools don’t just help you “do the math”—they help you think strategically about your business model.

Latest Global Trends in SME Financial Planning

Across the globe, SMEs are turning to smarter, faster, and more integrated financial planning solutions. Here are some key trends reshaping the landscape:

🔍 AI-Powered Forecasting

AI and machine learning are now being used to detect patterns and predict cash flow more accurately than ever before, learning from your transaction history and market data.

🛠️ No-Code/Low-Code Financial Tools

Platforms like Finmark, Brixx, and Causal offer intuitive, drag-and-drop interfaces—reducing the need for Excel skills while increasing accuracy and speed.

📊 Integrated Dashboards

Tools are now combining financial data with CRM, HR, and sales performance to give a full picture of business health in one place.

🏦 Embedded Finance in ERPs

Modern ERP systems are offering built-in budgeting tools that sync directly with banking and payment data—minimizing manual entry and reconciliation time.

Comparing Solutions: Build vs. Buy

| Solution | Pros | Cons |

| Excel + Templates | Highly customizable, low cost | Prone to human error, hard to scale |

| LivePlan / Brixx / Finmark | User-friendly, built for SMEs, visual dashboards | Subscription cost, limited deep customization |

| Custom-Built Tools | Tailored to your exact needs | Requires developer/finance expertise, higher upfront effort |

The right choice depends on your stage, team skillset, and strategic goals.

Actionable Steps for SMEs

- Audit Your Current Tools – Are you using spreadsheets that no one understands? Consider upgrading to a more intuitive platform.

- Define Key Assumptions – Growth rate, churn, hiring plans—map out the variables that drive your business.

- Create a 12–24 Month Cash Flow Forecast – Include different scenarios to stress-test your plan.

- Track Actuals vs. Budget Monthly – Use charts to visualize performance and adjust as needed.

- Use the Data to Drive Strategy – Let your numbers shape product plans, hiring decisions, and fundraising timing.

At MSME Strategy Consultants (global.msmestrategy.com), our experienced consultants are ready to guide you through customized financial modeling and strategic planning—so you can move from reactive budgeting to proactive growth planning.

#GlobalMSMEStrategy #FinancialModeling #BudgetPlanning #SMEGrowth #CashFlowManagement #SaaSFinance #MSMESolutions #FutureReadySMEs