Imagine running a small or medium-sized enterprise (SME) and constantly struggling with financial uncertainties:

- Your cash flow is unpredictable, making it hard to cover expenses.

- Taxation and regulatory compliance feel like a maze, and mistakes can be costly.

- You want to scale your business, but lack strategic financial insights.

- Hiring a full-time Chief Financial Officer (CFO) is too expensive.

These challenges are common for SMEs worldwide, particularly in trending markets like UK, Africa, and Austratlia, where quality financial expertise is often costly. However, the rise of Virtual CFO (vCFO) services is transforming how SMEs manage their finances, providing affordable, expert-level financial guidance without the cost of an in-house CFO.

What is a Virtual CFO?

A Virtual CFO is a remote financial expert who helps SMEs with budgeting, forecasting, risk management, financial strategy, and compliance. Unlike a traditional CFO, a vCFO works on-demand or on a part-time basis, making it a cost-effective solution for growing businesses.

How Does a Virtual CFO Differ from a Traditional CFO?

| Feature | Traditional CFO | Virtual CFO |

| Cost | High (Full-time salary + benefits) | Affordable (Flexible pricing) |

| Accessibility | Works on-site only | Remote, accessible globally |

| Expertise | Industry-specific experience | Diverse, multi-sector expertise |

| Scalability | Fixed salary, regardless of work | Scales as per business needs |

| Technology Integration | May rely on legacy systems | Uses AI, automation, cloud tools |

Key Benefits of a Virtual CFO for SMEs

1. Cost-Effective Financial Expertise

Hiring a full-time CFO can cost SMEs anywhere from $100,000 to $300,000 annually, which is beyond the budget of most small businesses. A Virtual CFO offers the same expertise at a fraction of the cost, making strategic financial planning accessible to SMEs.

2. Improved Cash Flow & Profitability

A vCFO analyzes spending patterns, revenue streams, and financial risks, helping businesses cut unnecessary expenses, improve pricing strategies, and enhance profitability.

3. Compliance & Tax Optimization

Regulatory frameworks vary across regions, and tax laws can be complex. A Virtual CFO ensures that your business:

✅ Stays compliant with tax regulations.

✅ Avoids penalties and legal complications.

✅ Optimizes tax structures to save money.

4. Data-Driven Decision-Making

A vCFO uses AI-powered financial analytics and cloud-based accounting tools to provide real-time insights into your business performance, ensuring better forecasting and investment decisions.

5. Scalability & Business Growth

Whether you’re expanding into new markets or securing investor funding, a Virtual CFO can prepare financial projections, analyze risks, and develop growth strategies tailored to your industry.

Latest Trends in Virtual CFO Services for SMEs

1. AI-Driven Financial Planning

Artificial Intelligence (AI) is transforming SME financial management. Virtual CFOs now use AI-powered tools for:

- Automated cash flow forecasting.

- AI-based fraud detection.

- Predictive financial modeling.

2. Cloud-Based CFO Services

With platforms like QuickBooks, Xero, and Zoho Books, Virtual CFOs can offer real-time, remote financial management to SMEs globally, ensuring greater transparency and efficiency.

3. On-Demand & Subscription-Based CFO Models

Instead of hiring a full-time CFO, SMEs can now subscribe to Virtual CFO services, scaling them as per business needs. This flexibility makes it easier for startups and growing enterprises to access top-tier financial expertise.

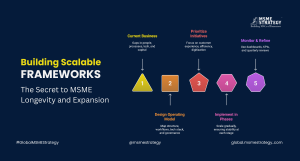

Actionable Steps for SMEs to Leverage Virtual CFO Services

- Identify Your Financial Challenges – Assess areas where you need financial expertise (e.g., cash flow, compliance, scaling).

- Explore Virtual CFO Providers – Look for vCFO services that specialize in your industry.

- Integrate Cloud Accounting Software – Use platforms like Xero, Tally, or QuickBooks to track finances efficiently.

- Set Clear Financial Goals – Work with a Virtual CFO to create a roadmap for business growth.

- Regular Financial Audits – Schedule quarterly reviews to analyze financial health and make data-driven adjustments.

Why SMEs Should Consider a Virtual CFO

In today’s highly competitive, fast-changing business landscape, financial clarity is key to SME success. A Virtual CFO provides cost-effective, high-level financial expertise that can drive profitability, enhance compliance, and enable long-term growth.

If you’re looking to optimize your SME’s financial health, MSME Strategy Consultants (global.msmestrategy.com) can help you navigate Virtual CFO solutions tailored to your business needs.

#MSMEStrategy #VirtualCFO #SMEFinance #FinancialGrowth #BusinessSuccess