In the current global business environment, cash flow remains the lifeblood of every SME. One of the most consistent disruptors of healthy cash flow is poor invoice management. Late payments, invoicing errors, and lack of follow-up processes often lead to a working capital crunch—especially for SMEs juggling limited resources. This article provides a strategic, step-by-step approach to optimizing invoice management and explores some of the most effective tools available in 2025 to support this crucial function.

Why Invoice Management Deserves Strategic Attention

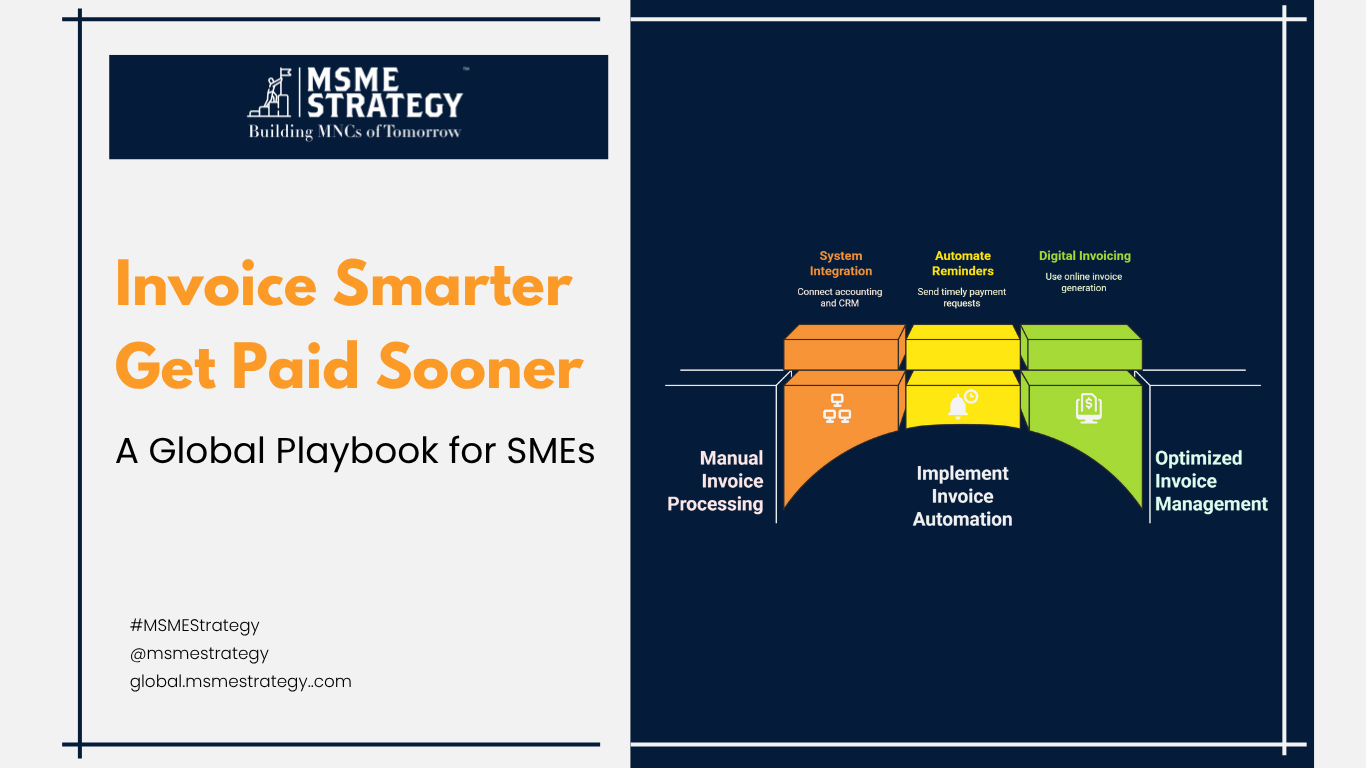

Many SMEs still rely on manual invoicing or disparate systems that don’t integrate with their accounting or CRM platforms. This creates bottlenecks, payment delays, and poor visibility over receivables. In contrast, optimized invoice management can:

- Improve working capital predictability

- Reduce debtor days (DSO)

- Strengthen client relationships through professionalism

- Free up time for strategic business activities

Step-by-Step: How to Analyse and Improve Invoice Management

Step 1: Map the Current Invoicing Workflow

Document your existing process—from generating the invoice to following up for payments. Identify all touchpoints: who creates the invoice, how it’s sent, what happens post-delivery, and when follow-ups are triggered.

Step 2: Calculate Key Metrics

Start by benchmarking the following:

- DSO (Days Sales Outstanding)

- Invoice Accuracy Rate

- Time to Invoice (from delivery to billing)

- Percentage of Overdue Invoices

These KPIs will help pinpoint inefficiencies.

Step 3: Identify Root Causes of Delays

Are delays stemming from incorrect client details, unclear payment terms, late follow-ups, or lack of automation? Collaborate with finance and sales teams to uncover the friction points.

Step 4: Standardize Invoice Formats & Terms

Use templates with:

- Clear payment terms

- Accurate client information

- PO references (if applicable)

- Tax details, bank details, and invoice numbers

Clarity reduces disputes and speeds up approvals.

Step 5: Automate the Process

Introduce invoicing automation tools to:

- Send invoices automatically after service delivery

- Track payments

- Send auto-reminders

- Reconcile payments with bank feeds

Top Trending Global Tools for Invoice Management

These platforms are helping SMEs globally to transform their billing and payment workflows:

- Zoho Invoice

Ideal for SMEs looking for customizable, cloud-based invoicing with automation and multilingual capabilities. - QuickBooks Online

A full accounting suite with invoicing, GST/VAT handling, recurring billing, and auto-reminders. - FreshBooks

Best for service-based businesses with time-tracking linked to invoices and expense management. - Xero

A global favorite with integrations across 1,000+ apps, including CRMs and inventory management. - Bill.com

Designed for end-to-end AR/AP automation. Good for SMEs scaling into mid-market territory. - Stripe Invoicing

Perfect for digital-first businesses with integrated payment processing and global currency support. - Chargebee

Best for subscription-based SMEs with recurring billing and revenue recognition tools.

Best Practices for Sustainable Invoice Management

- Set Expectations Upfront: Define payment terms clearly in contracts or SOWs. Include late fee policies.

- Invoice Promptly: Automate to send invoices immediately after delivery or milestone completion.

- Offer Multiple Payment Options: UPI, cards, ACH, wire transfer, PayPal, etc.

- Regular Follow-ups: Use automated reminders, followed by personalized emails or calls.

- Maintain Client Relationships: Communicate proactively before escalating.

- Monthly Receivables Review: Review aging reports and prioritize follow-ups.

- Use E-Invoicing (Where Required): In many jurisdictions, it’s now mandatory or offers tax benefits.

Actionable Points for SMEs

-Audit your current invoice process and calculate DSO

-Create a standardized, branded invoice template

-Automate invoice generation and follow-ups using a modern tool

-Provide diverse payment options

-Train your team on client-friendly collections etiquette

-Monitor receivables weekly using dashboards or KPIs

-Integrate invoicing with CRM or project management systems for faster turnaround

Invoice efficiency = cash flow consistency.

For SMEs operating in competitive, global markets, reducing payment delays is no longer optional—it’s a competitive advantage.

At MSME Strategy Consultants (global.msmestrategy.com), our experienced consultants are ready to help your SME implement smarter invoicing and cash flow strategies customized to your growth stage and industry.

#GlobalMSMEStrategy #InvoiceAutomation #CashFlowManagement #DSO #SMEFinance #SMEProductivity #AccountsReceivable #DigitalTransformation #WorkingCapital