To stay ahead in this volatile economy, your money must not just be managed—it must work for you. This means turning financial planning from a passive routine into a growth-driven strategy.

The challenge isn’t about discovering financial literacy—it’s about applying proven strategies to generate meaningful, sustained returns. Whether you’re operating in Nairobi or New York, Jakarta or Johannesburg, these globally-relevant principles can help future-proof your enterprise.

1. Shift from Operational Survival to Strategic Investment

Far too many SMEs remain trapped in a cycle of covering costs and reacting to short-term cash flow challenges. Strategic investment involves viewing capital as a resource to accelerate growth, not merely sustain operations.

- Automate essential but non-core functions (e.g., bookkeeping, inventory control).

- Invest in customer acquisition and retention tools, not just sales teams.

- Reinvest a fixed percentage of monthly profits into scalable assets—marketing, product development, or digital infrastructure.

2. Embrace Digital Finance Tools

Global trends show that SMEs using modern finance tools report 25–30% higher revenue growth over five years.

- Use cloud-based accounting software like Xero, Zoho Books, or QuickBooks Online for real-time visibility.

- Integrate cash flow forecasting platforms such as Float or Pulse.

- Monitor financial KPIs weekly, not quarterly. Automate alerts for burn rate, working capital, and debtor days.

3. Leverage Alternative Funding Wisely

Traditional loans aren’t the only way to grow. Depending on your geography and business type, consider:

- Revenue-based financing for flexible repayment linked to income.

- Fintech-based SME loans with fast approvals and data-driven underwriting (e.g., Kabbage, Funding Circle).

- Trade finance platforms like Drip Capital or CredAble for global exporters.

But beware: growth capital should never outpace operational capability. Ensure funding is linked to concrete outcomes.

4. Protect Cash Flow Like a Hawk

Profit is theory—cash flow is reality. Many profitable SMEs fail due to poor cash management.

- Renegotiate vendor contracts for longer payment terms.

- Offer early payment incentives to customers.

- Maintain a minimum 3-month cash reserve to absorb shocks.

Cash flow planning should be scenario-based, accounting for best, average, and worst-case outcomes.

5. Build Resilience through Diversification

The COVID-19 era proved one thing: single-channel or single-market dependency is risky.

- Diversify revenue streams—add a subscription model, service layer, or digital channel.

- Expand to international markets with online tools like Shopify Markets or Alibaba for B2B outreach.

- Develop partnership models—collaborate instead of compete.

Diversification isn’t complexity—it’s stability.

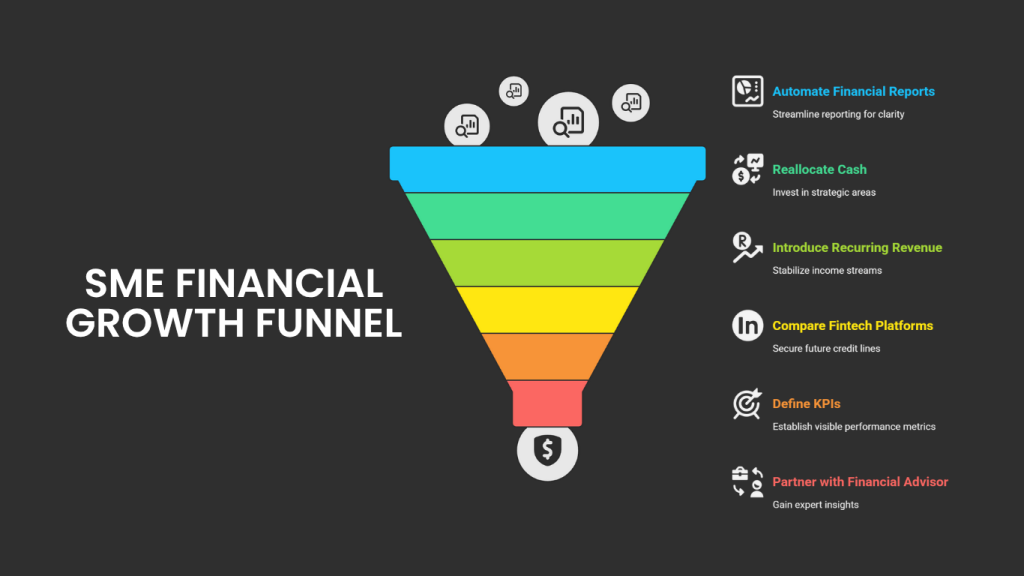

Actionable Strategies for Financial Growth

Here are 7 practical steps seasoned SME professionals can implement today:

- Conduct a 360° financial health audit—Review cost structure, revenue sources, and debt levels.

- Automate monthly financial reports—Use dashboards for clarity and faster decisions.

- Reallocate 10–20% of static cash into strategic investments (e.g., tech tools, staff training).

- Introduce a recurring revenue component to smooth out income variability.

- Compare 3 fintech lending platforms and set pre-approved credit lines for future needs.

- Define key financial KPIs—and make them visible across teams.

- Partner with a financial advisor or consultant quarterly to avoid blind spots.

Financial growth for SMEs is no longer about guesswork or survival tactics. It’s about being proactive, data-driven, and globally aware. With the right strategies, your money can become your most reliable employee—working 24/7 to drive the business forward.

At MSME Strategy Consultants, our experienced advisors work with SMEs across continents to implement growth-driven financial strategies. Let us help you make your capital count.

#GlobalMSMEStrategy #SMEGrowth #FinancialPlanningForSMEs #DigitalFinance #CashFlowManagement #SMEInvestment #AlternativeFunding #BusinessResilience