In today’s fast-paced business environment, SMEs are constantly seeking innovative solutions to enhance efficiency and remain competitive. One of the most effective ways to streamline financial management is through outsourced bookkeeping. While outsourcing financial tasks isn’t new, the latest technological advancements and evolving global trends have made this approach more strategic than ever.

Why SMEs Are Turning to Outsourced Bookkeeping

Many experienced SMEs understand the complexity of bookkeeping but often find that managing it in-house drains time and resources that could be better spent on core business functions. Outsourced bookkeeping offers cost savings, access to financial expertise, and the latest technology without the overhead of maintaining an internal accounting department.

Key benefits include:

- Cost Efficiency: Outsourcing reduces hiring, training, and software costs associated with an in-house finance team.

- Access to Expertise: Gain insights from experienced professionals who stay up-to-date with regulatory changes.

- Scalability: Easily scale bookkeeping services as your business grows.

- Enhanced Security: Cloud-based solutions offer secure data storage and access control.

Latest Trends in Outsourced Bookkeeping for SMEs

As outsourcing evolves, SMEs should keep an eye on emerging trends to leverage bookkeeping as a strategic asset rather than just an operational necessity. Here are some of the latest trends shaping the industry:

1. AI-Powered Bookkeeping

Artificial intelligence is revolutionizing bookkeeping by automating repetitive tasks, identifying anomalies in transactions, and generating real-time financial insights. AI-driven tools like Xero and QuickBooks leverage machine learning to streamline processes and minimize human error.

2. Cloud-Based Accounting Solutions

Cloud technology enables SMEs to access financial data anytime, anywhere. Leading outsourced bookkeeping firms now offer cloud-based platforms that integrate seamlessly with other business applications, providing real-time financial reporting and collaboration capabilities.

3. Blockchain for Financial Security

Blockchain technology is gaining traction in bookkeeping, offering immutable records and enhanced security. SMEs leveraging blockchain-based accounting solutions benefit from transparent transactions and reduced fraud risks.

4. Outsourced CFO Services

Beyond basic bookkeeping, many SMEs are now opting for outsourced CFO services to gain financial advisory support. These services help businesses make data-driven decisions, optimize cash flow, and strategize for long-term growth.

5. Regulatory Compliance Automation

Governments worldwide are implementing stricter financial regulations. Automated compliance solutions integrated with outsourced bookkeeping services ensure that SMEs adhere to tax laws, GDPR, and financial reporting standards without manual intervention.

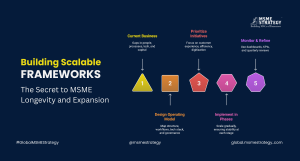

Actionable Steps for SMEs

- Evaluate Your Needs: Assess whether your business would benefit from outsourcing bookkeeping entirely or partially.

- Choose the Right Provider: Look for firms with expertise in your industry and experience in the latest bookkeeping technology.

- Leverage Automation: Opt for outsourced services that integrate AI, cloud computing, and compliance automation.

- Ensure Security Measures: Verify that the outsourcing provider uses encrypted data storage and multi-factor authentication.

- Monitor and Optimize: Regularly review financial reports and optimize services based on your evolving business needs.

Outsourced bookkeeping is no longer just about cost-cutting—it’s a strategic move for SMEs looking to enhance financial efficiency, security, and scalability. By embracing the latest technological trends, businesses can stay ahead of the competition and focus on growth.

At MSME Strategy Consultants (global.msmestrategy.com), our experienced consultants are ready to help SMEs integrate innovative bookkeeping solutions into their financial strategy.

#GlobalMSMEStrategy #OutsourcedBookkeeping #SMEGrowth #AIAccounting #CloudFinance #FinancialStrategy