Financial decision-making is no longer driven by instinct alone. Across global markets, data is transforming financial landscapes, reshaping how organizations—from multinational corporations to agile SMEs—approach resource planning, cost control, and strategic growth.

Financial data has evolved beyond spreadsheets. It is now dynamic, real-time, and accessible from anywhere. SMEs today operate in an environment of rapid market fluctuations, geopolitical instability, and changing customer behaviors. Financial resilience and agility depend on an SME’s ability to collect, interpret, and act upon timely data.

But having data is not enough.

SMEs must shift from data collection to data interpretation, using integrated dashboards that consolidate metrics, track performance, and support forecasting.

What Are Data Hubs and Dashboards?

- Data Hubs act as centralized repositories that bring together financial data from multiple sources—ERP systems, accounting software, POS systems, customer databases, and even external market feeds. They allow for data harmonization and readiness for analysis.

- Dashboards provide visual representations of key performance indicators (KPIs), trends, and forecasts—turning raw numbers into actionable business intelligence.

When connected, these tools allow SMEs to see the full financial picture in real time, empowering leaders to make quicker, more informed decisions.

The Global SME Imperative: Real-time Financial Visibility

From manufacturing units in Southeast Asia to service providers in Latin America and retailers in Europe, SMEs worldwide are experiencing:

- Increased regulatory compliance expectations

- Volatility in currency exchange and supply chain costs

- Accelerated digitization of financial transactions

- The need to manage multi-market operations with lean resources

A global SME must respond to these challenges with visibility, control, and automation, all of which are made possible by robust data infrastructure.

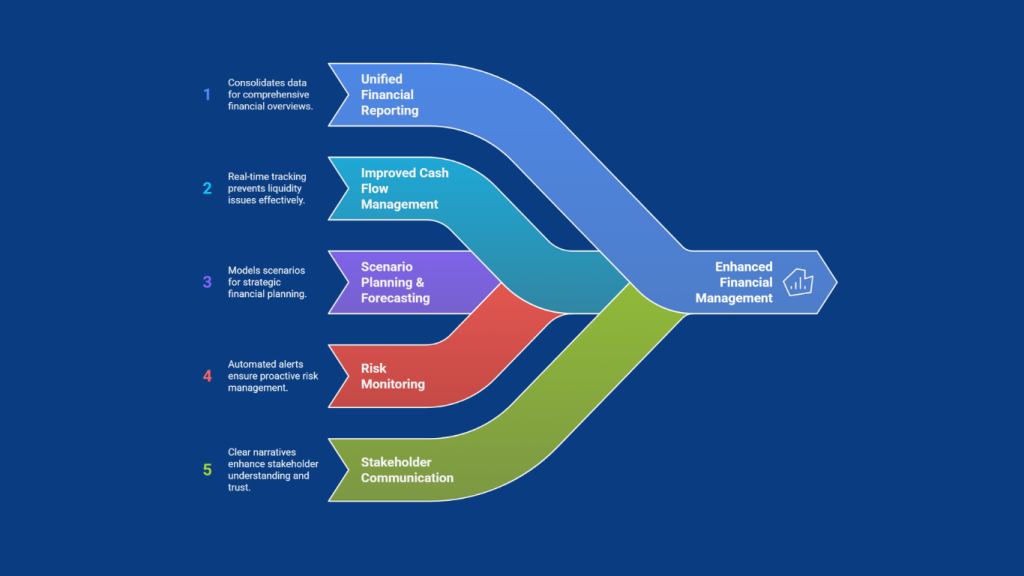

Key Benefits of Implementing Data Hubs & Dashboards

- Unified Financial Reporting

Consolidate financial data from multiple departments and geographies in a single interface. - Improved Cash Flow Management

Track inflows, outflows, payables, and receivables in real time to avoid liquidity crises. - Scenario Planning & Forecasting

Model “what if” scenarios for pricing, cost shifts, or market entry using live data inputs. - Risk Monitoring

Set automated alerts for anomalies, fraud indicators, or compliance breaches. - Better Communication with Stakeholders

Offer investors, lenders, and internal teams clear financial narratives backed by data.

Making It Work: How SMEs Can Get Started

1. Audit Current Financial Data Sources

Identify where your financial data is generated (e.g., accounting systems, invoices, bank feeds, CRM).

2. Select Scalable Technology

Choose platforms that allow integration across systems—preferably cloud-based, API-ready, and customizable.

3. Design Financial Dashboards Based on KPIs

Metrics may include:

- Operating margin

- Working capital turnover

- Revenue by segment

- Budget variance

- Forecast vs actuals

4. Train Teams to Use Data for Decisions

Building a data culture involves teaching finance, operations, and leadership teams how to interpret and act on visualized insights.

5. Use AI and Automation for Efficiency

Integrate AI tools for trend analysis, anomaly detection, and automated report generation.

Actionable Steps for SMEs

| Area | Action |

| Data Infrastructure | Implement a centralized data hub (e.g., Microsoft Power BI Gateway, Google BigQuery, Snowflake) |

| Dashboards | Use tools like Tableau, Zoho Analytics, Power BI, or Looker tailored to your financial KPIs |

| Team Readiness | Upskill finance teams on data literacy and dashboard interpretation |

| Governance | Set data policies for access control, accuracy, and compliance |

| Continuous Improvement | Schedule monthly dashboard reviews with leadership to fine-tune business strategy |

SMEs that use data strategically are not just surviving—they are outperforming their competition. Whether you’re navigating supply chain uncertainty, exploring funding, or preparing for expansion, real-time financial intelligence is your compass.

And with the right tools, mindset, and expert support, the journey is not just possible—it’s profitable.

MSME Strategy Consultants

At global.msmestrategy.com, our experienced consultants are ready to help your SME design and implement the right data strategy for smarter financial decisions and sustainable growth.

#GlobalMSMEStrategy #DataDrivenSME #FinancialDashboards #SMEFinance #DataHubs #SMEDigitalTransformation #FinancialIntelligence #RealTimeData #SmartFinance