Every dollar counts—especially for small and medium enterprises (SMEs) competing in dynamic markets. Traditional end-of-month financial reviews often fail to capture wasteful spending before it spirals out of control. Real-time expense monitoring, on the other hand, gives SMEs the ability to track costs as they occur, take proactive decisions, and strengthen financial discipline across the organization.

Why Real-Time Expense Monitoring Matters

For SMEs, cash flow is lifeblood. Delayed insights into spending can lead to missed opportunities, strained liquidity, or inflated budgets. Real-time monitoring ensures:

- Immediate visibility into where money is going.

- Proactive controls that prevent small oversights from turning into big leaks.

- Smarter decision-making, with leaders able to adjust spending before it impacts profitability.

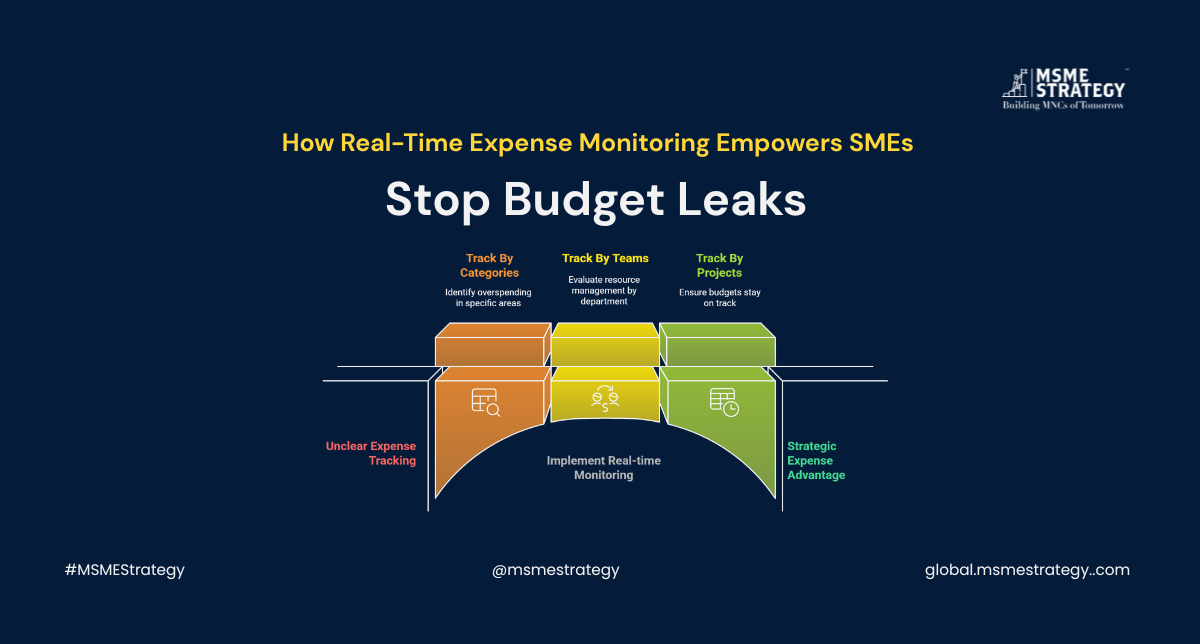

Smarter Tracking: By Categories, Teams, or Projects

Implementing real-time expense monitoring is more than just adopting a tool—it’s about building financial clarity across operations. By organizing expenses into meaningful categories, SMEs can identify patterns and root causes of inefficiency.

- By Categories: Track costs under travel, marketing, IT, or operations to spot areas of overspending.

- By Teams: Evaluate how different departments manage resources and encourage accountability.

- By Projects: Monitor project-based spending to ensure budgets stay on track and margins remain healthy.

This structured approach transforms expense management from a reactive task into a strategic advantage.

The Strategic Benefits for SMEs

Real-time monitoring is not about restricting teams—it’s about empowering them with clarity and discipline. SMEs that adopt smart tracking methods often experience:

- Reduced waste through early detection of unnecessary or duplicate expenses.

- Improved forecasting based on accurate, up-to-the-minute data.

- Enhanced transparency that builds trust within teams and with stakeholders.

- Controlled growth, where resources are directed toward value-creating activities instead of unplanned costs.

Ultimately, SMEs that embrace proactive expense controls are better positioned to scale sustainably and compete globally.

About MSME Strategy Consultants

At MSME Strategy Consultants (global.msmestrategy.com), our experienced consultants partner with SMEs worldwide to identify growth opportunities, optimize resources, and future-proof operations.

MSME Strategy also gives you a comprehensive tool to diagnose your business and provides a detailed diagnostic report—absolutely free. Click here to get your customized report and uncover key insights for your growth.

Primary: #GlobalMSMEStrategy

Secondary Suggestions:

#SMEGrowth #ExpenseManagement #BudgetControl #FinancialStrategy #BusinessOptimization #SustainableGrowth