Cash flow is the oxygen of every business — yet many small and medium enterprises (SMEs) lose a surprising amount of it without realizing. These losses often hide behind inefficiencies: delayed collections, unmonitored expenses, bloated inventories, or outdated approval systems. Over time, these “silent leaks” erode profitability, strain liquidity, and limit the ability to scale.

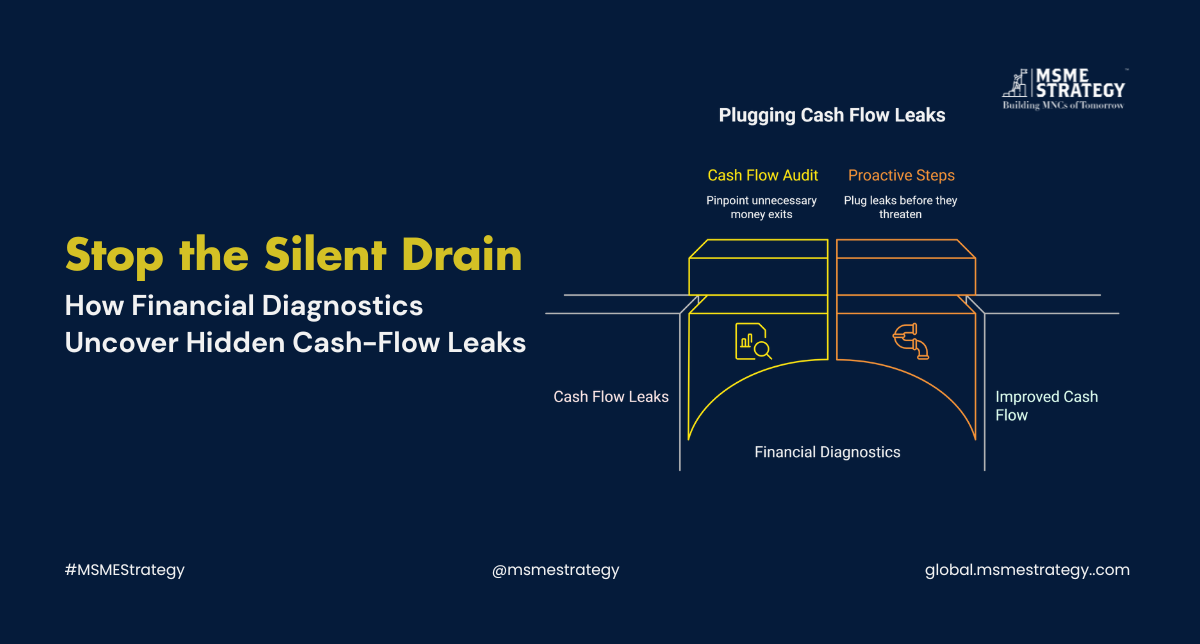

Financial diagnostics offer a structured, data-driven way to find and fix these issues. By conducting a systematic cash-flow audit, SME leaders can pinpoint where money exits the system unnecessarily and take proactive steps to plug the leaks before they threaten growth.

Step-by-Step Framework to Audit and Close Cash-Flow Leakages

1. Map All Cash Inflows and Outflows

Begin with a complete financial map — identify every inflow (sales, receivables, interest, investment income) and every outflow (purchases, payroll, logistics, taxes, and rent). This visibility helps locate irregularities and inefficiencies.

Pro Tip: Use digital accounting tools or ERP dashboards to ensure accuracy and real-time updates.

2. Identify Unproductive Expenses

Compare budgeted costs to actual spending and analyze recurring variances. Look closely at areas like procurement, logistics, and inventory holding costs — these are often where silent leakages occur.

3. Review Receivables and Payables Cycles

Cash-flow strain often arises from delayed collections or poor credit discipline. Financial diagnostics highlight debtor aging patterns and help businesses recalibrate payment terms, improving liquidity without additional financing.

4. Evaluate Operational Efficiency

Audit procurement and payment processes. Even small process delays — such as manual approvals or redundant verifications — can freeze working capital. Streamlining these workflows enhances liquidity and control.

5. Benchmark Key Financial Ratios

Analyze metrics such as the cash conversion cycle (CCC), current ratio, and operating margin. Benchmark them against your industry peers to uncover hidden inefficiencies and evaluate your true financial health.

6. Integrate Real-Time Financial Dashboards

Digital dashboards offer an instant snapshot of financial performance. By visualizing key performance indicators (KPIs), decision-makers can detect anomalies early and adjust spending or collections before they impact cash flow.

7. Implement Corrective and Preventive Actions

Once leaks are identified, classify them as one-time or recurring. Address immediate issues first — such as closing overdue receivables — and then implement preventive measures like automated payment systems, tighter vendor contracts, or improved forecasting.

The Payoff: A More Predictable, Profitable Enterprise

Enterprises that perform regular financial diagnostics report stronger liquidity, better cost control, and improved strategic decision-making. Beyond numbers, diagnostics build financial confidence — empowering leaders to plan expansion, secure funding, and reinvest profits efficiently.

In today’s fast-moving business environment, financial visibility is power. Every dollar you save from leakages can be reinvested into growth, innovation, and resilience.

About MSME Strategy Consultants

At MSME Strategy Consultants (global.msmestrategy.com), our experienced consultants partner with SMEs worldwide to identify growth opportunities, optimize resources, and future-proof operations.

MSME Strategy also offers a comprehensive business diagnostic tool that generates a detailed, customized report — completely free.

Click here https://resources.msmestrategy.com/diagnose-my-business to access your diagnostic report and uncover actionable insights for your growth.

#GlobalMSMEStrategy #FinancialDiagnostics #CashFlowAudit #SMEGrowth #ProfitabilityAnalysis #BusinessOptimization #CashManagement #StrategicFinance