The ability to interpret real-time financial data has evolved from a competitive edge to an operational necessity. In today’s interconnected markets, even marginal inefficiencies in cash flow or profit margins can compound into significant setbacks. A robust financial diagnostic toolkit is no longer optional—it’s integral to performance optimization, investment readiness, and sustainable expansion.

This article explores diagnostic tools and strategies that enable SMEs to gain deep financial visibility. From advanced analytics platforms to global trends like predictive modeling and integrated fintech, we present insights that align with the needs of established businesses seeking sharper financial control and scalable efficiency.

Core Elements of a Financial Diagnostic Toolkit

- Cash Flow Analysis

- Monitor inflows and outflows using cloud-based accounting tools.

- Identify patterns in delayed payments or seasonal sales dips.

- Maintain a rolling 12-month forecast.

- Profit Margin Evaluation

- Calculate gross, operating, and net profit margins.

- Analyze profitability per product or service line.

- Use cost-volume-profit (CVP) analysis to test price or volume changes.

- Operational Efficiency Audits

- Benchmark costs against industry standards.

- Conduct time-motion studies or workflow mapping.

- Review vendor contracts and supply chain bottlenecks.

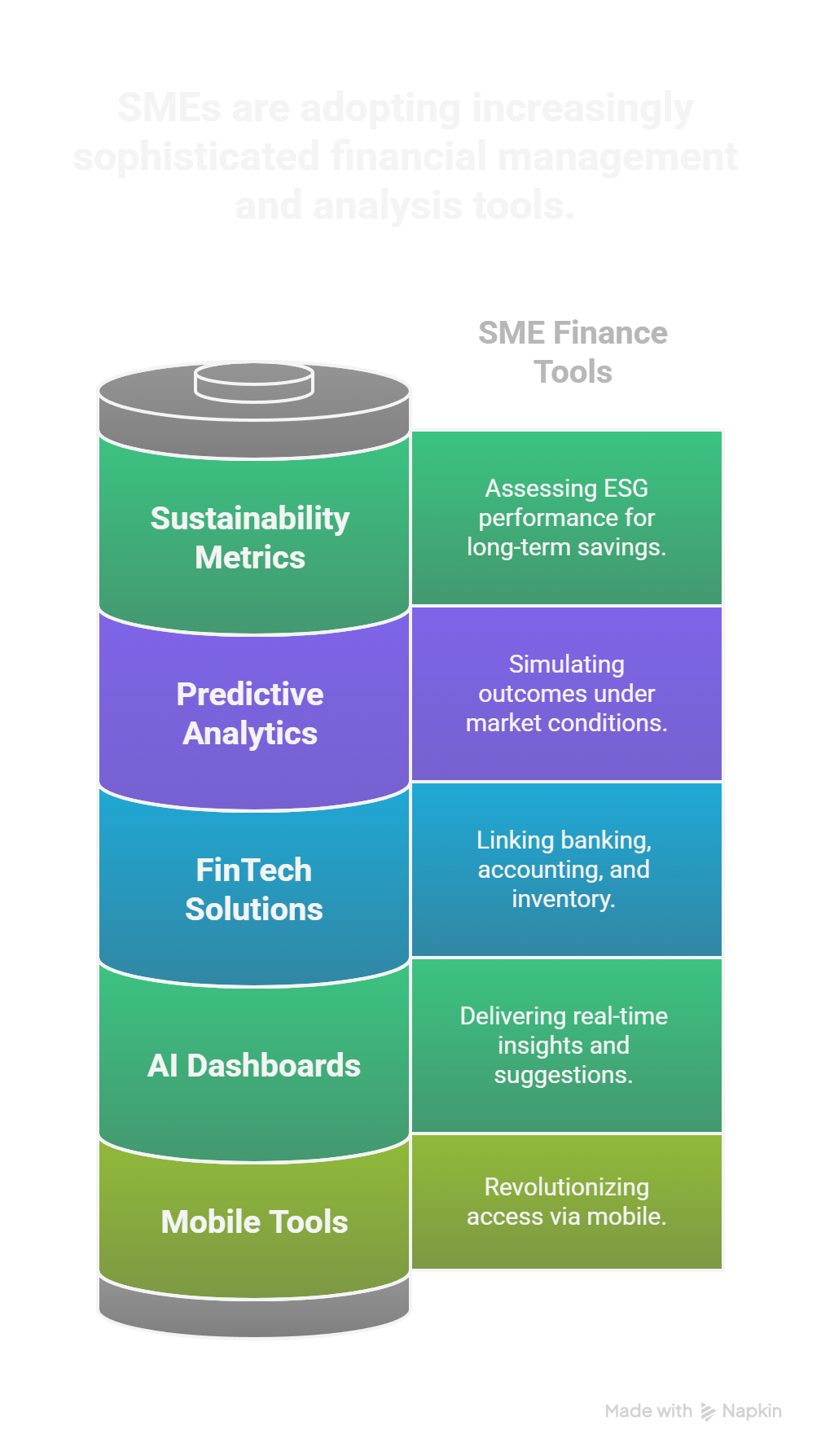

Latest Global Trends in Financial Diagnostics for SMEs

- AI-Powered Financial Dashboards

Tools like QuickBooks, Xero, and Zoho Books now integrate AI to deliver real-time cash flow insights, flag anomalies, and even suggest corrective actions. - Predictive Analytics and Scenario Planning

SMEs are increasingly adopting forecasting software to simulate financial outcomes under various market conditions. - Integrated FinTech Solutions

From digital banking to payment gateways, SMEs globally are embracing integrated platforms that link banking, accounting, and inventory—creating a holistic financial view. - Sustainability Metrics

Particularly in Europe and Asia, SMEs are beginning to assess financial diagnostics alongside ESG (Environmental, Social, and Governance) performance—factoring in long-term cost savings from sustainable practices. - Mobile-First Tools

In regions like Sub-Saharan Africa and Southeast Asia, mobile-based financial tools are revolutionizing access to real-time data and digital transactions.

Actionable Points for SMEs

- Adopt a Cloud-Based Accounting System

It centralizes your financial data and makes real-time diagnostics easier. - Conduct a Monthly Financial Health Check

Track key metrics such as liquidity ratio, accounts receivable turnover, and ROI. - Integrate AI Tools

Use platforms with built-in analytics to anticipate cash shortages or profit dips. - Invest in Financial Literacy

Regularly upskill your team or hire expert consultants to interpret diagnostics accurately. - Benchmark and Review Quarterly

Compare your performance against industry standards and adapt strategies accordingly.

A structured financial diagnostic approach can transform how SMEs operate, from reactive firefighting to proactive planning. By leveraging global best practices and technology trends, small businesses can stay competitive, profitable, and ready for scalable growth.

Experienced consultants at MSME Strategy Consultants are ready to help you implement effective financial strategies tailored to your needs.

#GlobalMSMEStrategy #SMEFinance #CashFlowManagement #BusinessGrowth #FinancialHealth #MSMESuccess