Financial discipline isn’t just a back-office function — it’s a growth engine. For SMEs, quarterly financial reviews act like a health check-up, helping identify early warning signs, cash flow gaps, and growth opportunities before they escalate. Whether you’re a founder, CFO, or senior executive, conducting a concise financial diagnostic every quarter ensures that your decisions are grounded in facts, not assumptions.

Here’s a CFO’s 1-hour quarterly toolkit — five essential financial checks every SME should perform to stay agile, compliant, and growth-ready.

1. Cash Flow Reality Check

Your profit might look strong, but liquidity is the real measure of sustainability.

Review your operating cash flow — Are inflows consistently covering outflows?

Assess payment cycles — How many days are your receivables taking?

Forecast upcoming needs — Can you meet short-term liabilities comfortably?

Tip: Use a rolling 13-week cash flow forecast to visualize upcoming inflows and outflows. This keeps you prepared for lean months and helps maintain supplier trust.

2. Profitability and Margin Review

Margins reveal more than revenue does.

Compare gross and net margins across products, services, or business units.

Investigate any sharp deviations from the last quarter.

Identify unprofitable customers or SKUs and explore ways to improve pricing or efficiency.

Quick Diagnostic: Check if your net profit margin is consistent over three quarters. Any decline signals either a pricing issue or rising operational inefficiency.

3. Working Capital Efficiency

Working capital is your business’s bloodstream — too tight, and operations choke; too loose, and efficiency drops.

Evaluate your inventory turnover: Are you overstocked?

Review payables vs. receivables balance: Are you financing your customers at your expense?

Monitor your current ratio (Current Assets ÷ Current Liabilities). A healthy ratio (1.2–2.0) indicates stability.

Action Point: Identify and liquidate slow-moving inventory every quarter to free up cash and reduce carrying costs.

4. Debt and Leverage Assessment

Leverage can accelerate growth — or strain your balance sheet if unmanaged.

Review your debt-to-equity ratio and ensure it aligns with your industry norms.

Revisit interest obligations — Are your loan terms still favorable?

Check interest coverage ratio to ensure your earnings comfortably cover debt servicing.

Insight: Refinancing or restructuring high-cost loans once a year can significantly improve cash flow and profitability.

5. Expense and Cost Optimization Review

Expenses tend to creep up silently. A quarterly review helps keep them in check.

Compare actual vs. budgeted expenses.

Spot recurring non-core costs that can be reduced or outsourced.

Use digital tools to track expense categories automatically.

Bonus Tip: Classify expenses as value-adding or non-value-adding. This simple exercise often uncovers 10–15% savings potential.

Bringing It All Together

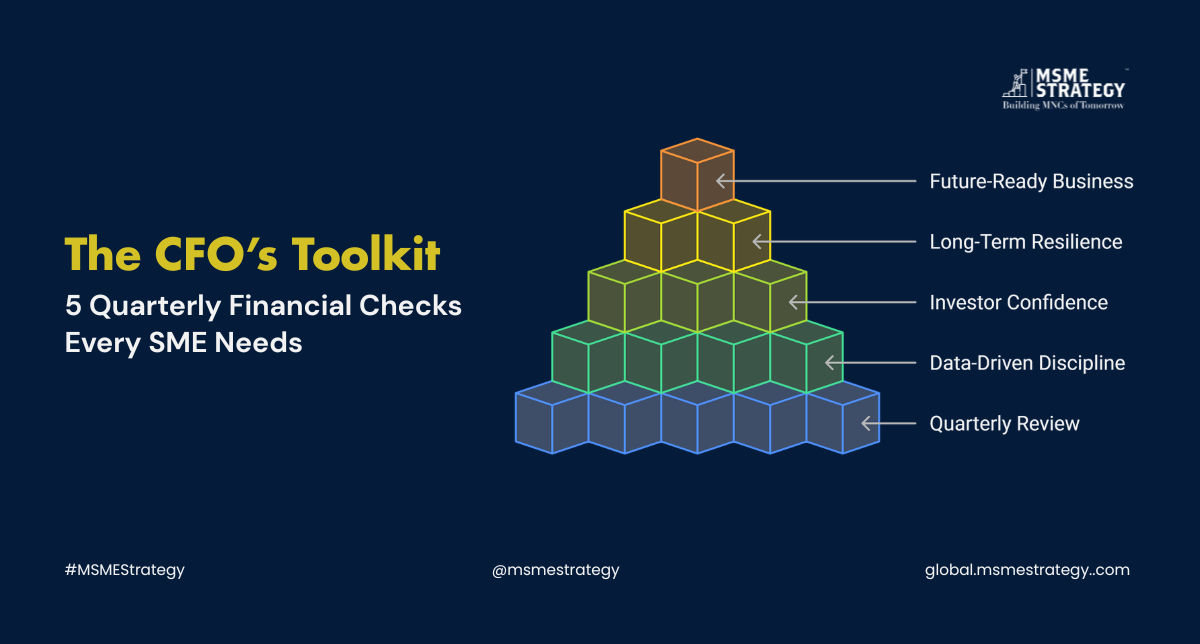

A structured quarterly financial diagnostic doesn’t require a finance degree — just an hour of focused review and the right questions. Over time, these five checks form a data-driven discipline that strengthens decision-making, builds investor confidence, and drives long-term resilience.

Whether you manage a local enterprise or a global SME, treating your finances like a living system — one that’s measured, adjusted, and improved regularly — is the hallmark of a truly future-ready business.

About MSME Strategy Consultants

At MSME Strategy Consultants, our experienced consultants partner with SMEs worldwide to identify growth opportunities, optimize resources, and future-proof operations.

MSME Strategy also gives you a comprehensive tool to diagnose your business and provides a detailed diagnostic report.

Click here [link of the page] to get your customized report and uncover key insights for your growth.

Primary: #GlobalMSMEStrategy

Secondary: #CFOChecklist #QuarterlyFinancialReview #SMEFinanceChecks #MSMEStrategy #BusinessDiagnostics #FinancialHealth