Whether you’re preparing for international partnerships, looking to raise capital, or simply streamlining operations, transparent and timely financial reporting is central to building trust and driving informed decisions.

In this article, we explore best practices in SME financial reporting, followed by a curated list of top five global tools that help businesses stay compliant, agile, and future-ready.

Why Financial Reporting Matters for SMEs

Financial reporting provides a clear picture of business health—cash flows, profitability, liabilities, and assets. For SMEs operating across borders or seeking international funding, standardised and accurate reporting is often the entry point for credibility.

Moreover, regulators, investors, banks, and stakeholders expect timely and standardized financial disclosures aligned with frameworks such as IFRS (International Financial Reporting Standards) or GAAP (Generally Accepted Accounting Principles), depending on jurisdiction.

Best Practices in Financial Reporting for SMEs

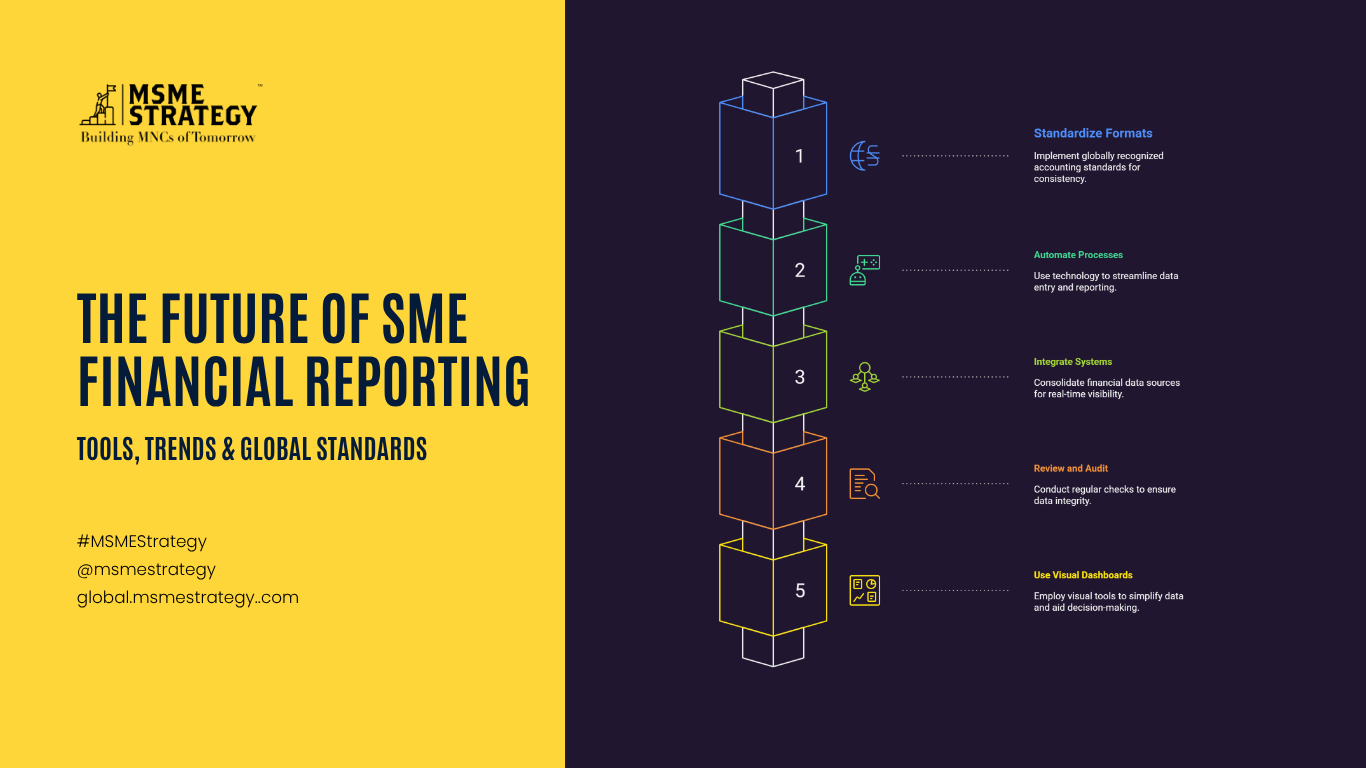

Here are five best practices SMEs across sectors and countries should adopt:

1. Standardize Reporting Formats

Use globally recognized accounting standards (e.g., IFRS, GAAP) for consistency and comparability—especially vital when dealing with international partners or investors.

2. Automate Where Possible

Manual processes are error-prone and time-consuming. Automating data entry, reconciliation, and reporting ensures efficiency and reduces the risk of compliance issues.

3. Integrate Financial Systems

Consolidate disparate financial data sources—sales, payroll, inventory, taxation—into one ecosystem. Integration leads to real-time visibility and fewer surprises at the end of the quarter.

4. Review and Audit Regularly

Internal reviews and periodic external audits help ensure data integrity, flag discrepancies early, and support better strategic decision-making.

5. Use Visual Dashboards

Beyond spreadsheets, visual dashboards simplify complex data and enable decision-makers to act fast. It also helps in communicating financial data clearly to non-financial stakeholders.

Top 5 Financial Reporting Tools for SMEs

These tools are scalable, cloud-based, and trusted by SMEs across industries and geographies:

1. Xero

A favorite among SMEs in New Zealand, Australia, and the UK, Xero offers robust reporting features, bank feeds, and multi-currency capabilities. Its real-time dashboard is ideal for finance teams and founders alike.

2. QuickBooks Online

Widely used in North America, QuickBooks is easy to use and offers strong reporting, tax filing, and forecasting tools. Integrations with payroll and CRM tools make it an all-in-one financial suite.

3. Zoho Books

Perfect for SMEs in Asia and the Middle East, Zoho Books supports GST/VAT compliance, multi-lingual invoices, and deep automation. Its intuitive design and integrations with Zoho ecosystem are a bonus.

4. Sage Business Cloud Accounting

Popular in Europe and Africa, Sage is known for its precision, compliance alignment, and comprehensive reporting capabilities. Ideal for SMEs with more complex operational structures.

5. Wave (for micro-SMEs and startups)

Free yet powerful, Wave is a great entry-level tool for early-stage SMEs. It includes invoicing, payment tracking, and basic reporting—all cloud-based.

Actionable Takeaways for SMEs

- Adopt a reporting tool that aligns with your region, compliance needs, and scalability goals.

- Create monthly and quarterly reporting routines that include balance sheets, cash flow statements, and profit & loss reports.

- Train your team to understand key financial metrics—empowering them to make informed business decisions.

- Involve external consultants periodically to benchmark your financial practices against global peers.

- Stay updated on regulatory changes across your operating markets to ensure ongoing compliance.

MSME Strategy Consultants (global.msmestrategy.com) have worked with SMEs across continents, helping them build resilient financial reporting systems and navigate international compliance with confidence. Our experienced consultants are ready to help you elevate your reporting practices to global standards.

#GlobalMSMEStrategy #SMEFinance #FinancialReporting #IFRSCompliance #SMEGrowth #CloudAccountingTools #SustainableSMEs